“The regulators, especially SEBI, wants brokers to earn only from brokerage and not from anything else. This is a big challenge for the entire industry,” Kamath said.

Interestingly, the pessimism comes at a time when a large section of the Indian population is turning to investments in financial products. However, the same unprecedented interest from small investors, particularly in high-risk segments like futures and options (F&O), has drawn the market regulator’s attention too.

Nearly three-fourths of all the trading volume came from F&O for many broking firms.

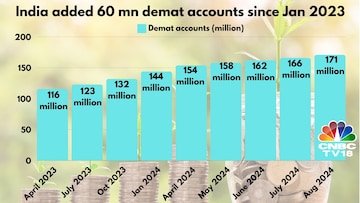

India’s stock market has seen a surge in retail investors, with demat accounts surpassing 171 million as of August 2024, a figure bigger than the entire populations of Russia, Mexico, and Japan

SEBI has introduced several rules to curb the enthusiasm. These include higher entry barriers, stricter margin requirements, and regulations like the “True to Label” circular effective from October 2024. This circular alone is expected to cause a 10% dip in Zerodha’s revenue.

In a recent post on social media platform X, Kamath — who last valued Zerodha at $3.6 billion in September 2023 — outlined several upcoming regulatory changes that could significantly impact Zerodha’s earnings.

These include new rules for index derivatives, which could result in a 30-50% revenue drop, increased Securities Transaction Tax (STT), and limitations on referral programs that will curtail customer acquisition efforts. “We are already seeing revenue and profit plateau, and we are bracing for a big revenue hit later this year,” Kamath wrote.

Also Read: Zerodha’s Nithin Kamath on the impact of new SEBI regulations

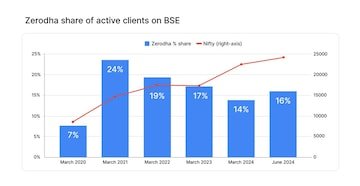

Zerodha, founded over a decade ago, has grown into one of India’s largest stockbrokers, boasting ₹5.66 lakh crore in assets under custody.

Source: Zerodha

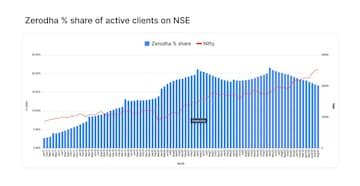

There’s also the rising competition from startups like Groww and other listed brokers such as 5Paisa, ICICI Securities, and IIFL Securities, has intensified the pressure on Zerodha’s market position.

The company has been profitable, reporting ₹4,700 crore in profit last year, but Kamath acknowledges that the combination of regulatory changes and heightened competition poses a significant challenge for the industry as a whole.

Source: Zerodha

With the broking industry facing these headwinds, Kamath suggests that Zerodha will need to adapt, perhaps by raising brokerage fees or exploring new revenue streams.

However, he remains confident in the company’s strong product offering, which has allowed Zerodha to charge account opening fees for over a decade.

Also Read: No Zerodha IPO! Kamath doesn’t want the burden of investor expectations

“The fact that 1.4 crore Indians paid an account opening fee says something about the product,” he said, hinting that a premium product could continue to set Zerodha apart in a highly competitive space.