scyther5

Key takeaways

- The fund underperformed

- Class A shares underperformed the MSCI ACWI ex-US SMid Index during the quarter. This was due to short-term spending patterns in segments of information technology (‘IT’) and health care where the fund is invested. Longer term, we believe secular trends will support the fund’s holdings.

- Capital costs matter

- In our view, equity valuations have largely been adjusted to account for higher capital costs. However, we believe the variable effect of higher capital costs on corporate earnings and returns is what will matter going forward.

- Time-tested discipline

- We will continue to practice our time-tested discipline: seeking to invest in consistently profitable companies with high internal rates of return on their capital, that fund operations through internal cash flow without the need for bank financing, and that have strong balance sheets.

Manager perspective and outlook

Equity markets opened the second quarter with a correction, giving back much of the previous quarter’s gain. However, after bottoming in mid-April, the US and emerging markets recovered lost ground and advanced further while developed non-US equities lagged.

As in recent quarters, attention centered on the US Federal Reserve (Fed) and the outlook for US interest rate policy. Fed guidance signaled only one rate cut this year and not before September “at the earliest.” Equities rose after the news, which we believe shows valuations have been adjusted for higher capital costs. However, we think the variable effect of higher capital costs on corporate earnings and returns is what matters going forward.

The fund underperformed for the quarter primarily due to recent spending patterns in IT and health care. Spending on software and IT consulting has slowed while companies have continued to formulate AI strategies. Once strategies are in place, we anticipate activity will pick up for IT consultants that help companies execute them. In health care, the growth pattern of many equipment and consumable suppliers has been disrupted: first boosted by a COVID-induced demand spike and now slowed by clients’ need to work off overstocked inventory. While this has caused volatility in quarter-to-quarter returns and share price movements, we believe the underlying secular growth trends supporting these companies remain in place.

Portfolio positioning

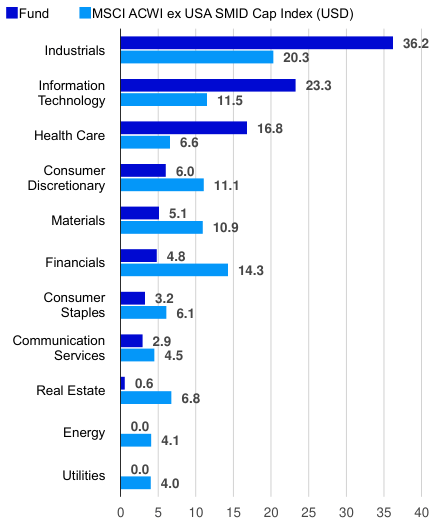

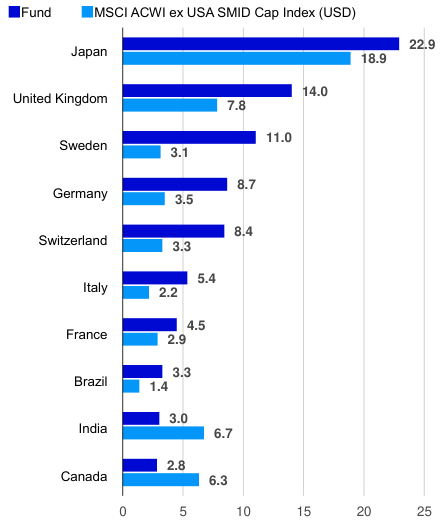

Our high conviction, low turnover portfolio has a consistent structure that changes little from quarter to quarter. We are benchmark independent, bottom-up investors, focusing on company fundamentals rather than using a “top-down” perspective to overweight or underweight any sector or region. We seek companies supported by structural growth trends in the global economy; that have significant pricing power; can fund operations and growth with operating cash flow; and have strong balance sheets. We find the bulk of our targets in the industrials, health care and IT sectors. We historically tend to avoid the utilities and real estate sectors, which are viewed as bond proxies, and sectors with many industries whose products are commoditized, such as energy and materials.

We added three new positions during the quarter.

Carel Industries is an Italian designer, manufacturer and distributor of HVAC and refrigeration systems. We believe it has leading positions in the market for “clean” refrigerants. We find Carel’s business model, operating margins, capital returns, prospects and valuation attractive.

Coway is a Korea-based company with a door-to-door distribution model for air and water filtering and purification. Its after-sales services provide a high portion of revenues. In our opinion, Coway’s track record for return on invested capital is attractive.

Park Systems, based in South Korea, is the market share leader in atomic force microscopes (AFMs), sold primarily to the semiconductor industry. As semiconductor chip sizes have shrunk, demand for AFMs has risen because conventional electronic microscopes cannot scan nodes smaller than 20 nanometers (a nanometer is about the size of an atom). In our opinion, Park Systems is well-placed to benefit from the continuing miniaturization trend in semiconductors.

We exited one position.

New Work (OTCPK:XINXF), based in Germany, operates Xing, a professional social-media platform comparable to LinkedIn, and Kununu, a workplace-review platform comparable to Glassdoor. Dominance of these platforms in German-speaking markets attracted us to the company. In the process of transforming its social networks to business recruiting tools, New Work began shifting to a subscription business model. As we have seen with every other internet platform/software company that made this transition, profits initially softened. The share price declined. During the quarter, New Work’s 70% majority owner bought the remainder of the shares, taking the company private.

Top issuers (% of total net assets)

|

Fund |

Index |

|

|

Obic Co Ltd (OTCPK:OBIIF) |

2.30 |

0.09 |

|

Carl Zeiss Meditec AG (OTCPK:CZMWF) |

1.82 |

0.03 |

|

Partners Group Holding AG (OTCPK:PGPHF) |

1.58 |

0.00 |

|

Descartes Systems Group Inc/The (DSGX) |

1.54 |

0.09 |

|

DiaSorin SpA (OTCPK:DSRLF) |

1.54 |

0.02 |

|

Nice Ltd (NICE) |

1.38 |

0.11 |

|

VZ Holding AG (VZIO) |

1.36 |

0.00 |

|

Azbil Corp (OTCPK:YMATF) |

1.35 |

0.03 |

|

CCL Industries Inc (OTCPK:CCDBF) |

1.29 |

0.08 |

|

Spirax Group PLC (OTCPK:SPXSF) |

1.24 |

0.08 |

|

As of 06/30/24. Holdings are subject to change and are not buy/sell recommendations. |

||

Sector breakdown (% of total net assets)

Top countries (% of total net assets)

Performance highlights

The fund outperformed most in the consumer discretionary sector due to stock selection and its underweight position, and in the real estate sector due to the usual underweight position.

The fund underperformed in the health care, IT and materials sectors, all due to stock selection.

Contributors to performance

Alpha Financial Markets, based in the UK, provides consulting services to the asset management business. During the quarter, Alpha Financial received an all-cash takeover bid from private equity firm Bridgepoint and the shares rose close to the offer price.

Sdiptech (OTC:SDTHF), a Swedish company, provides public infrastructure control systems for water treatment, transportation, building climate control and security. During the quarter Sdiptech announced earnings that exceeded analysts’ forecasts.

Restore is a UK-based document storage and management company, much like Iron Mountain (not a fund holding) in the US. During the quarter, the share price reacted favorably to the company’s release of revenue and guidance numbers.

MISUMI (OTCPK:MSUXF), based in Japan, distributes precision machine parts to specialized industries such as hospitals and restaurants and to manufacturers. Its customers appear more sensitive to reliability and delivery speed than price. The company reported earnings and provided guidance during the quarter and the share price reacted favorably.

Mips (OTCPK:MPZAF), based in Sweden, is the world’s leading supplier of interior safety systems for sports helmets. It has established a recognizable brand among end users, much as Intel did with “Intel Inside.” During the quarter, Mips raised its earnings guidance.

Detractors from performance

Carl Zeiss, based in Germany and the global leader in ophthalmic surgery lenses, has been supported by an aging world population and increasing access to health care in emerging markets. That said, shorter term sales volumes have slowed in the aftermath of COVID-related overstocking by customers. During the quarter, management issued a profit warning.

NICE produces software to optimize call centers and customer service. The CEO announced he would be stepping down. After examining the issue thoroughly, we are comfortable that the business is fine, and he simply wants to take on new challenges.

Sartorius, based in Germany, is a leading maker of precision equipment and components for research and production in the biologic drug industry. Sartorius’ sales have slowed after an above-trend period. In our opinion, the company’s clients are working off inventory.

Bruker (BRKR), arguably the market leader in spectrometers, primarily for drug developers and researchers, is another supplier for whom inventory de-stocking has suppressed recent profit growth.

ChemoMetec (OTCPK:CHHMF), based in Denmark provides cell counters for life science research. In a pattern familiar to us, post-COVID destocking has suppressed near-term growth.

Top contributors (%)

|

Issuer |

Return |

Contrib. to return |

|

Alpha Financial Markets Consulting plc |

52.80 |

0.33 |

|

Sdiptech AB |

25.49 |

0.22 |

|

Restore plc |

25.67 |

0.16 |

|

MISUMI Group Inc. |

25.80 |

0.16 |

|

Mips AB |

21.47 |

0.15 |

Top detractors (%)

|

Issuer |

Return |

Contrib. to return |

|

Carl Zeiss Meditec AG |

-43.74 |

-1.16 |

|

NICE Ltd. |

-34.02 |

-0.62 |

|

Sartorius AG |

-40.92 |

-0.60 |

|

Bruker Corporation |

-32.02 |

-0.44 |

|

ChemoMetec A/S |

-28.99 |

-0.31 |

|

Quarter |

YTD |

1 Year |

3 Years |

5 Years |

10 Years |

Since inception |

||

|

Class A shares (MUTF:OSMAX) inception: 11/17/97 |

NAV |

-5.37 |

-4.45 |

-0.31 |

-7.49 |

1.95 |

5.85 |

10.65 |

|

Max. Load 5.5% |

-10.57 |

-9.70 |

-5.80 |

-9.22 |

0.80 |

5.25 |

10.42 |

|

|

Class R6 shares (MUTF:OSCIX) inception: 12/29/11 |

NAV |

-5.29 |

-4.28 |

0.07 |

-7.15 |

2.33 |

6.27 |

10.60 |

|

Class Y shares (MUTF:OSMYX) inception: 09/07/05 |

NAV |

-5.30 |

-4.32 |

-0.07 |

-7.26 |

2.20 |

6.11 |

9.37 |

|

MSCI ACWI ex USA SMID Cap Index (‘USD’) |

-0.07 |

2.38 |

10.30 |

-1.65 |

5.05 |

3.92 |

– |

|

|

Total return ranking vs. Morningstar Foreign Small/Mid Growth category (Class A shares at NAV) |

– |

– |

90% (114 of 127) |

66% (81 of 116) |

80% (90 of 115) |

14% (10 of 79) |

– |

|

|

Expense ratios per the current prospectus: Class A: Net: 1.35%, Total: 1.35%; Class R6: Net: 0.99%, Total: 0.99%; Class Y: Net: 1.11%, Total: 1.11%. Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit Country Splash for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Returns less than one year are cumulative; all others are annualized. As the result of a reorganization on May 24, 2019, the returns of the fund for periods on or prior to May 24, 2019 reflect performance of the Oppenheimer predecessor fund. Share class returns will differ from the predecessor fund due to a change in expenses and sales charges. Index sources: Invesco, RIMES Technologies Corp. Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. Performance shown at NAV does not include the applicable front- end sales charge, which would have reduced the performance. Class Y and R6 shares have no sales charge; therefore performance is at NAV. Class Y shares are available only to certain investors. Class R6 shares are closed to most investors. Please see the prospectus for more details. For more information, including prospectus and factsheet, please visit Invesco.com/OSMAX Not a Deposit Not FDIC Insured Not Guaranteed by the Bank May Lose Value Not Insured by any Federal Government Agency |