Maskot

The Neuberger Berman Real Estate Securities Income Fund Inc (NYSE:NRO) is a closed-end fund, or CEF, that aims to provide investors with a very high level of income by investing in real estate securities. This is a sector that has been something of a mixed bag for investors over the past few years. In theory, real estate should work pretty well as a hedge against inflation and the loss of purchasing power.

Kiplinger’s points out in an article earlier this year that real estate investment trusts proved to be a much better asset than stocks or bonds during the stagflation period in the 1970s. There have been rumblings in some corners of the market that we may be entering a similar period today, although as of right now, gross domestic product growth is too strong to actually call today’s economic environment a period of stagflation. Nonetheless, real estate has generally proven to be resistant to inflation and serves as a store of value. With that said, high vacancy rates in the commercial office sector coupled with the highest interest rates that we have seen in twenty years have resulted in poor returns for most real estate portfolios over the past two years. That might be at least partially due to the price of many real estate investment trust common stocks being too high in 2021, however.

The Neuberger Berman Real Estate Securities Income Fund generally does pretty well for income-focused investors who are seeking to earn some money from their portfolios. As of the time of writing, the fund yields 10.73%, which is a somewhat higher yield than that possessed by most closed-end funds today. However, due in part to the suppressed performance of the real estate sector compared to other assets, most closed-end funds that invest in this sector have very high yields right now. For example, consider the following:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Neuberger Berman Real Estate Securities Income Fund |

Equity-Real Estate |

10.73% |

|

Cohen & Steers Real Estate Opportunities & Income Fund (RLTY) |

Equity-Real Estate |

8.61% |

|

Nuveen Real Estate Income Fund (JRS) |

Equity-Real Estate |

8.22% |

|

Principal Real Estate Income Fund (PGZ) |

Equity-Real Estate |

12.00% |

|

abrdn Global Premier Properties (AWP) |

Equity-Real Estate |

11.82% |

|

CBRE Global Real Estate Income Fund (IGR) |

Equity-Real Estate |

13.00% |

It is important to note that the last two funds in this list do not focus on the domestic real estate market, but are global funds that purchase shares of real estate investment trusts from all over the world. This makes a significant difference in their performance because U.S. Real Estate (IYR) has substantially outperformed international real estate (IFGL) over the past year:

However, at the same time, the international real estate index boasts a much higher current yield than the American one. This impacts the returns that these last two funds can produce, and thus will result in their yields not being directly comparable. However, both of them have more than 60% of their assets invested in American real estate investment trusts, so they are still acceptable as peer funds for our comparison.

We can immediately see that the Neuberger Berman Real Estate Securities Income Fund does not have the highest yield that is available among its peers, although it does still manage to beat the Cohen & Steers Real Estate Opportunities & Income Fund as well as the Nuveen Real Estate Income Fund. This is a good sign, as it suggests that income-focused investors do not have to give up too much current income with this fund compared to what it is theoretically capable of delivering. At the same time, it does not have an excessively high yield like some of its peers, so the market appears to believe that it should be able to sustain its distribution. We will still want to be sure to investigate this further, though, as quite a few real estate closed-end funds have been failing to cover their distributions recently.

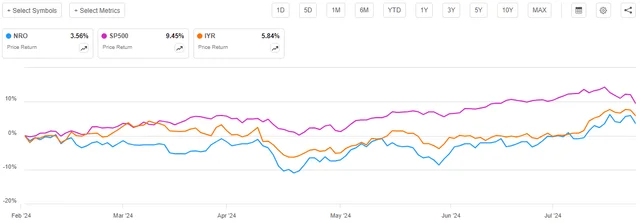

As regular readers might remember, we previously discussed the Neuberger Berman Real Estate Securities Income Fund in early February of this year. The equity market since that time has generally been pretty strong, but the same cannot be said for the fixed-income market. Bond yields and long-term interest rates have generally risen this year as investors have begun to expect that the Federal Reserve will hold its benchmark interest rate at very high levels. Real estate investment trusts tend to be affected by interest rates in the same way as bonds because higher interest rates reduce the cash flow that landlords can get from a certain level of rental income. As such, we can probably expect that the shares of the Neuberger Berman Real Estate Securities Income Fund have not delivered a particularly attractive return since our last discussion.

This is indeed the case. As we can see here, the common shares of the Neuberger Berman Real Estate Securities Income Fund have only risen by 3.56% since the date of my previous article’s publication:

This is certainly disappointing, especially because this fund underperformed both the S&P 500 Index (SP500) and the iShares U.S. Real Estate ETF, which tracks domestic real estate investment trusts. However, at least it did deliver a positive return, which is nice considering all the headlines that we continue to see describing the carnage in certain sectors of the real estate market.

It is important to keep in mind though that investors in this fund have done quite a bit better than this share price performance suggests. As I stated in the previous article on this fund:

We should keep in mind that the fund’s share price performance alone does not tell investors how well investors in the fund actually did during a given period. This is because closed-end funds tend to pay out nearly all of their investment profits to the shareholders while maintaining a relatively stable net asset value. This typically results in these funds having very high yields that provide an additional return to the investors. As such, investors in a closed-end fund will typically have a higher return than would be expected based on the share price performance alone.

The domestic real estate index will also do a bit better than the price performance suggests because real estate investment trusts usually pay out a very high proportion of their cash flows to the investors, which gives them higher yields than many other market assets. When we take the distributions that were paid out by the Neuberger Berman Real Estate Securities Income Fund as well as the domestic real estate index since early February into account, we get this alternative performance chart:

This is certainly interesting. As we can clearly see, the Neuberger Berman Real Estate Securities Income Fund easily managed to beat the domestic real estate index since early February. This is perhaps not particularly surprising, since this fund has a substantially higher yield than the index. What is very surprising though is that this fund actually managed to beat the S&P 500 Index over the period. When we consider how often we hear about problems in the real estate market in the financial media, that is not what we expected. It is something that any investor in this fund will appreciate, however. After all, we all like to beat the market with our investments.

It is naturally important to remember that past performance is no guarantee of future results. We need to look at the fund’s positioning today rather than merely its historical performance, since we will only benefit from events that occur in the future. As more than five months have passed since our previous discussion, we can assume that there have been some changes to the fund’s portfolio that we need to investigate. In addition, the fund released an updated financial report, so we will want to discuss that as well to ensure that it is covering its distribution properly.

About The Fund

According to the fund’s website, the Neuberger Berman Real Estate Securities Income Fund has the primary objective of providing its investors with a high level of current income. This would ordinarily be a very unusual objective for an equity fund, due to the simple fact that equities do not provide much in the way of income. For example, consider the trailing twelve-month yields of both the domestic and international real estate indices:

|

Index ETF |

TTM Yield |

|

iShares U.S. Real Estate ETF |

2.77% |

|

iShares International Developed Real Estate ETF |

3.48% |

These yields are both lower than that of a money market fund right now. They are also well below the yields that can be obtained from a portfolio of U.S. Treasury bills. Thus, it makes no real sense to invest in equities if a fund’s goal is to earn income. Many real estate investment trusts issue preferred securities and similar things, and these would overall be better for income if the fund wishes to earn income while maintaining a real estate focus.

With that said, the website does not explicitly state that the Neuberger Berman Real Estate Securities Income Fund invests in common equities. All the website states is this:

Neuberger Berman

The website does make note of “superior stock selection” being a component of its strategy, but otherwise, all it says is that the fund invests in securities issued by real estate companies. This does not technically exclude preferred stocks or bonds that are issued by a real estate investment trust. The phrase “superior stock selection” would normally be construed as implying common equity investments, however.

The fund’s semi-annual report does not explicitly discuss the fund’s strategy. In fact, it does not even have the word “strategy” anywhere in the document. This is a bit disappointing, as a fund’s financial documents usually include a better strategy description than what is provided on a webpage. It does provide the following asset allocation, however:

|

Asset Type |

% of Net Assets |

|

Common Stocks |

84.0% |

|

Preferred Stocks |

46.5% |

|

Master Limited Partnerships |

0.8% |

|

Money Market Fund |

0.7% |

It certainly seems a bit odd to see a master limited partnership included in a real estate fund. After all, most investors would typically equate this type of security with the energy industry. However, the law that allows companies to organize as master limited partnerships does state that they can operate in the energy, natural resources, or real estate sectors. The one (there is only one) that is included in the portfolio of the Neuberger Berman Real Estate Securities Income Fund is a real estate partnership:

These are preferred units of Brookfield Property Partners, yielding 6.25% at par. The fund’s documentation is not clear on this, but these are probably the Class A Cumulative Redeemable Preferred Units, Series 1 (BPYPM). These securities currently trade at $15.73 each, so they are yielding well above the 6.25% par value. Indeed, its quarterly distribution of $0.390625 gives it a 10.08% current yield. This seems to imply that the market expects Brookfield Property Partners to default on the distribution, but so far, the partnership has given no signs that it has to do this. Brookfield Property Partners itself is not publicly traded and does not need to release its results, but the last time that it did trade in the public markets, its cash flow was more than sufficient to cover the distribution many times over. For now, there is probably no reason to expect that the fund will stop receiving the distributions from these securities.

As the master limited partnership position consists of preferred and not the common, that brings the fund’s allocation to preferred securities up to 47.3% of net assets. That is more than half of its 84% allocation to common equities. Thus, it appears that the fund has a 60/40 to 65/35 split between common and preferred equity issued by real estate companies in its portfolio. This is a bit different from some other real estate funds on the market that invest solely in common equities. It also might improve the fund’s appeal among income-seekers and risk-averse investors alike. After all, preferred equities tend to have significantly higher yields than common equities. Preferred equities are also generally considered to be a bit safer for investors in the event of financial difficulties at the issuing company. The fact that the fund holds between 35% and 40% of its assets in preferred securities therefore means that it will have a higher income with a lower overall risk than a comparable fund that is invested solely in common equities. It is easy to see why this should be attractive.

The largest positions in the fund should be pretty familiar to anyone who follows the real estate industry. Here they are:

We see here that there are two preferred stock issues among the largest positions in the fund’s portfolio. However, the remainder of the positions here consist of common equities. Unfortunately, many of these common equities have fairly low yields:

|

Company |

Current Yield |

|

American Tower Corporation (AMT) |

3.13% |

|

Simon Property Group (SPG) |

5.34% |

|

Prologis (PLD) |

3.12% |

|

Public Storage (PSA) |

4.06% |

|

Crown Castle (CCI) |

5.94% |

|

AvalonBay Communities (AVB) |

3.30% |

|

Welltower (WELL) |

2.23% |

|

Iron Mountain (IRM) |

2.68% |

With an ordinary money market fund yielding just over 5% right now, only two of these companies have attractive yields. With that said, all of them are more attractive than the yield of the S&P 500 Index, so perhaps we should not complain too much.

One thing that could be concerning though is that Crown Castle has been flagged by Seeking Alpha’s Quant system as being likely to deliver poor performance in the near future. From the warning page:

Crown Castle Inc. has characteristics which have been historically associated with poor future stock performance. CCI has decelerating momentum and negative EPS revisions when compared to other Real Estate stocks, to the point that it gets a Sell rating from our Quant rating system. Stocks rated Sell or worse have substantially underperformed S&P 500, as this article will describe.

Over the past three years, Crown Castle is down 45.11%, which is quite horrible even for a real estate stock. The iShares U.S. Real Estate ETF is only down 13.17% over the same period:

This might partly be attributed to the fact that Crown Castle was caught up in the post-pandemic bubble, due to expectations that the growing popularity of remote work would result in fifth-generation cellular towers being constructed all over the country. That obviously did not play out as investors at the time assumed, and when combined with the rising interest rates, the stock lost much of its former appeal.

There have been quite a few changes to the fund’s largest positions list since the date of our last discussion. The most notable of these changes is that Kimco Realty (KIM), Ventas (VTR), and Starwood Property Trust (STWD) were all removed from their former positions among the fund’s largest holdings. In their place, we have AvalonBay Communities, Welltower, and Iron Mountain. In addition to this, there were a few changes in the weightings and the overall order of the holdings in the list, but this could easily be explained by one company outperforming another in the market. It is not necessarily a sign of the fund actively introducing changes to its portfolio.

Even though three out of ten of the largest positions in the fund were changed over the past five months, the Neuberger Berman Real Estate Securities Income Fund does not have an especially high turnover rate. However, the Neuberger Berman Real Estate Securities Income Fund only had a 7% turnover in its most recent fiscal year. This is substantially lower than the fund’s peers:

|

Fund Name |

Turnover Rate |

|

Neuberger Berman Real Estate Securities Income Fund |

7.00% |

|

Cohen & Steers Real Estate Opportunities & Income Fund |

59.00% |

|

Nuveen Real Estate Income Fund |

33.00% |

|

Principal Real Estate Income Fund |

37.00% |

|

abrdn Global Premier Properties |

44.00% |

|

CBRE Global Real Estate Income Fund |

50.69% |

The low turnover might have a positive impact on the fund’s expense ratio, which CEF Data puts at 2.68% right now. The fund’s semi-annual report states that the Neuberger Berman Real Estate Securities Income Fund had a 1.36% expense ratio in the first six months of the current fiscal year:

Fund Semi-Annual Report

However, this appears to be the fund’s expense ratio before considering the costs of leverage, which can be substantial. This is still pretty reasonable for a closed-end fund, although investors who are used to the expense ratios of unleveraged passive index funds will probably find it a bit high.

I have seen in the comment sections of a few previous articles that some readers dislike expense ratios above 1% when a fund’s turnover is very low, as is the case with this fund. This is mostly because the belief is that management is being paid a significant amount of money for basically doing nothing. However, just because a fund’s turnover is very low in one year does not mean that it will always be low. The Neuberger Berman Real Estate Securities Income Fund is a perfect example of this, as it had an annualized turnover rate of 16% in the first half of the current fiscal year. The fund has also had much higher turnover ratios in the past:

|

FY 2023 |

FY 2022 |

FY 2021 |

FY 2020 |

FY 2019 |

|

|

Portfolio Turnover |

7% |

27% |

22% |

21% |

3% |

Thus, when the fund has a low turnover rate during a single year, it is merely a sign that the fund’s management did not see any opportunities worthy of making a change to the portfolio. It does not mean that they simply sat on their hands and did nothing. Thus, investors are not paying a fee to the managers for doing nothing per se.

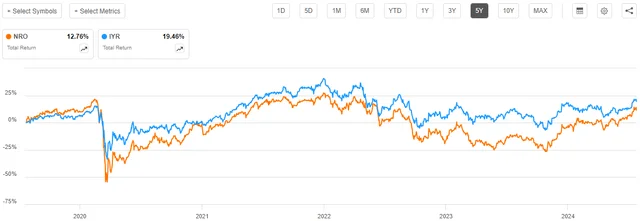

Personally, I do not mind high fees as long as the fund’s performance is sufficient to justify the fees. Unfortunately, that does not appear to be the case with this fund. Over the past five years, the Neuberger Berman Real Estate Securities Income Fund has delivered a 12.76% total return. This is worse than the iShares U.S. Real Estate ETF:

This fund did manage to outperform the index by quite a lot over the past twelve months, though:

While the management definitely earned their fee over the past twelve months, most investors who are looking to purchase an income investment want to hold it for a fairly extended period. This fund’s underperformance over the past five years certainly does not speak well of it. The fund also only very slightly beat the index over the past ten years:

Overall, this fund looks decent, but its long-term performance track record drags it down a few notches. The fact that it is using leverage should result in it outperforming during any sort of strength in the real estate market, though. The only real weakness in real estate is the office sector, and falling interest rates should be a tailwind for the rest of the industry. Thus, there could be a case made for this fund outperforming at least in the short term once the Federal Reserve finally starts to reduce interest rates.

Leverage

As is the case with most closed-end funds, the Neuberger Berman Real Estate Securities Income Fund employs leverage as a method of boosting the effective total return that it earns from the assets in its portfolio. I explained how this works in my last article on this fund:

Basically, the fund borrows money and then uses that borrowed money to purchase common and preferred securities issued by real estate investment trusts. As long as the total return of the purchased securities is higher than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the fund’s portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to too much risk.

As of the time of writing, the Neuberger Berman Real Estate Securities Income Fund has leveraged assets comprising 24.47% of its total assets. This is certainly better than the one-third maximum ratio that we would ordinarily like to see, but it is a bit worse than the 23.29% ratio that the fund had the last time that we discussed it. That may be concerning for risk-averse investors, as higher leverage typically translates to higher risk. However, it should also boost the fund’s profits when the real estate market finally recovers.

As we can see here, the fund’s net asset value is up 2.01% since we last discussed it:

It is thus somewhat surprising that its leverage ratio would increase. After all, if its borrowings were stable, then they should not represent a smaller proportion of a larger portfolio. The fund may have increased its borrowings, though (perhaps to boost returns in the recent market rally), which would explain the increase in the leverage ratio.

The Neuberger Berman Real Estate Securities Income Fund has a very reasonable level of leverage compared to its peers:

|

Fund Name |

Leverage Ratio |

|

Neuberger Berman Real Estate Securities Income Fund |

24.47% |

|

Cohen & Steers Real Estate Opportunities & Income Fund |

34.60% |

|

Nuveen Real Estate Income Fund |

27.75% |

|

Principal Real Estate Income Fund |

29.70% |

|

abrdn Global Premier Properties |

17.20% |

|

CBRE Global Real Estate Income Fund |

30.90% |

(all figures from CEF Data.)

As we can clearly see, the Neuberger Berman Real Estate Securities Income Fund has a lower level of leverage than all except for one of its peers. This is a good sign, as it suggests that the fund is not currently running an excessive level of leverage, despite the slight increase that it experienced over the past few months. Thus, investors in this fund probably do not need to lose any sleep over its current use of leverage.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Neuberger Berman Real Estate Securities Income Fund is to provide its investors with a high level of current income. In accordance with this objective, the fund pays a monthly distribution of $0.0312 per share ($0.3744 per share annually) to its investors. This gives the fund a 10.73% yield at the current price.

We naturally want to ensure that the fund can afford its distribution, since we would rather not be the victims of a surprise distribution cut. For that, we should take a look at the fund’s recently released semi-annual report that corresponds to the six-month period that ended on April 30, 2024. A link to this document was provided earlier in this article. This is a newer report than what was available to us the last time that we discussed this fund, so it should work pretty well to provide an update.

For the six-month period that ended on April 30, 2024, the Neuberger Berman Real Estate Securities Income Fund received $6,374,606 in dividends and $41,266 in interest from the assets in its portfolio. From this total, we subtract the small amount of money that the fund had to pay in foreign withholding taxes. This gives it a total investment income of $6,414,978 for the period. The fund paid its expenses out of this amount, which left it with $4,243,245 available for shareholders. That was, unfortunately, not sufficient to cover the $8,883,727 that the fund paid out in distributions during the period.

Fortunately, the fund was able to make up the difference through capital gains. For the six-month period, the fund reported net realized gains of $3,588,415 along with net unrealized gains of $13,296,351. Overall, the fund’s net assets increased by $12,244,284 after accounting for all inflows and outflows during the period.

Thus, we can see that the Neuberger Berman Real Estate Securities Income Fund managed to cover its distributions during the six-month period with a substantial amount of money left over. However, it did fail to cover the distribution with net realized gains and net investment income, so the only reason that the fund’s net asset value increased was because of its net unrealized gains. While this could prove problematic if the fund does not lock in those gains before a market correction, there are no signs that such a correction might be on the horizon. For the most part, everything appears to be okay here, and the distribution is probably safe.

Valuation

Shares of the Neuberger Berman Real Estate Income Securities Fund are currently trading at a 0.84% discount to net asset value. This is substantially pricier than the 2.46% that the shares have traded at on average over the past month, so right now does not appear to be a great entry point. It would be best to wait until the discount increases.

Conclusion

In conclusion, the Neuberger Berman Real Estate Securities Income Fund has been a fairly decent performer recently, as it outperformed the real estate sector in general over the past year. The fund does invest in a troubled sector, though, so it might be a good idea to be cautious. At this point, though, the interest rate headwind has probably abated, since it seems unlikely that the Federal Reserve will raise interest rates any further.

When and if the central bank starts to cut rates, real estate stocks should do pretty well, and Neuberger Berman Real Estate Securities Income Fund Inc is likely to outperform the sector due to the leverage that it employs. The fund boasts a very attractive 10.73% yield, and it has finally managed to cover it during a full six-month reporting period. The only real problem with this fund right now is that the discount is smaller than average.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.